how to pay indiana state withholding tax

Know when I will receive my tax refund. Indiana State Income Tax Withholding Calculator.

Dor Unemployment Compensation State Taxes

Formerly many Indiana withholding tax payers could pay on paper.

. What are the payroll tax filing requirements. Indiana tax calculator is an easy tool for computing the amount of withholding tax on your salary income. Know when I will receive my tax refund.

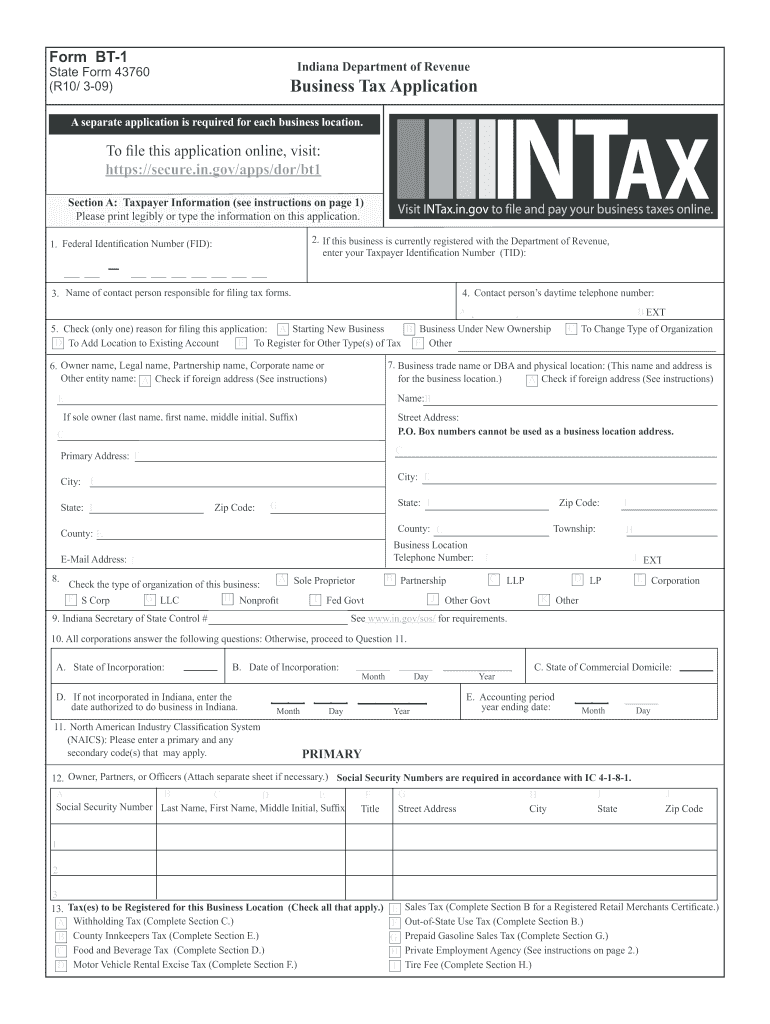

INBiz can help you manage business tax obligations for Indiana retail sales withholding out-of-state. Annual Nonresident Military Spouse Earned Income Withholding Tax Exemption Form. For the feds.

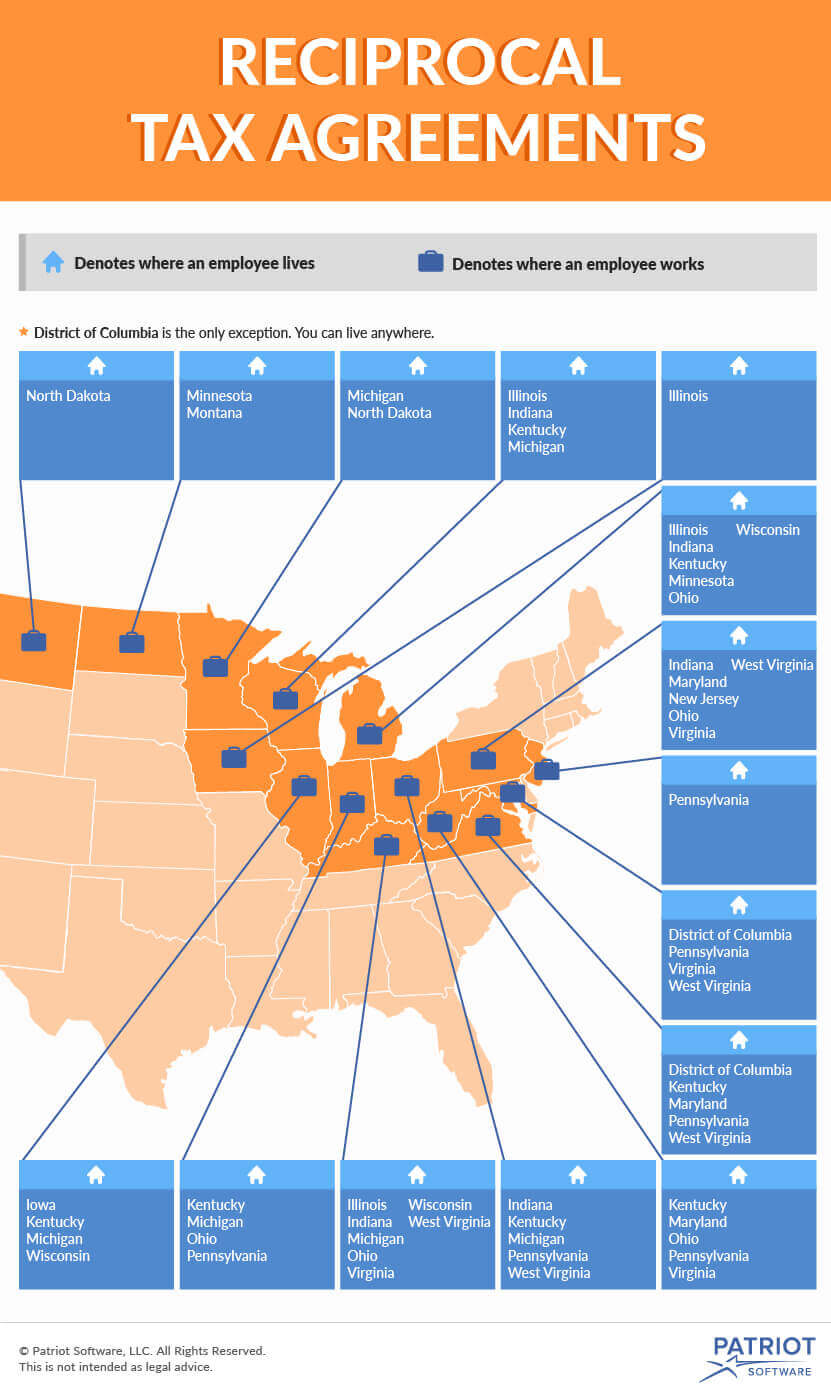

Your browser appears to have cookies disabled. Residents of Indiana are taxed at a flat state income rate of 323. Register For Indiana Withholding Tax will sometimes glitch and take you a long time to try different solutions.

Up to 25 cash back Here are the basic rules on Indiana state income tax withholding for employees. Annual Nonresident Military Spouse Earned Income Withholding Tax Exemption Form. It has created the New and Small Business.

Indiana businesses have to pay taxes at the state and federal levels. All counties in Indiana impose their own local. Does not obligate your employer to withhold the amount.

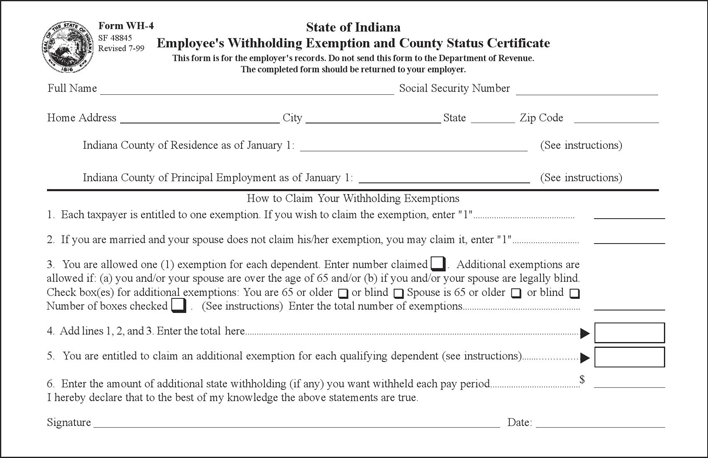

Employees Withholding Exemption County Status Certificate. LoginAsk is here to help you access Register For Indiana Withholding Tax. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident.

Indiana state income tax withholding calculator also takes into account any tax that a county may imposeThis is. All businesses in Indiana must file and pay their sales and withholding taxes electronically. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident.

Find Indiana tax forms. Indiana has a flat state income tax rate of 323 for the 2021 tax year which means that all Indiana residents pay the same percentage of their income in state taxes. Employees Withholding Exemption County Status Certificate.

Find Indiana tax forms. A withholding agent who fails to withhold and pay to the Department any money required to be withheld and paid is personally individually and corporately liable to the State of Iowa. That means no matter how much you make youre taxed at the same rate.

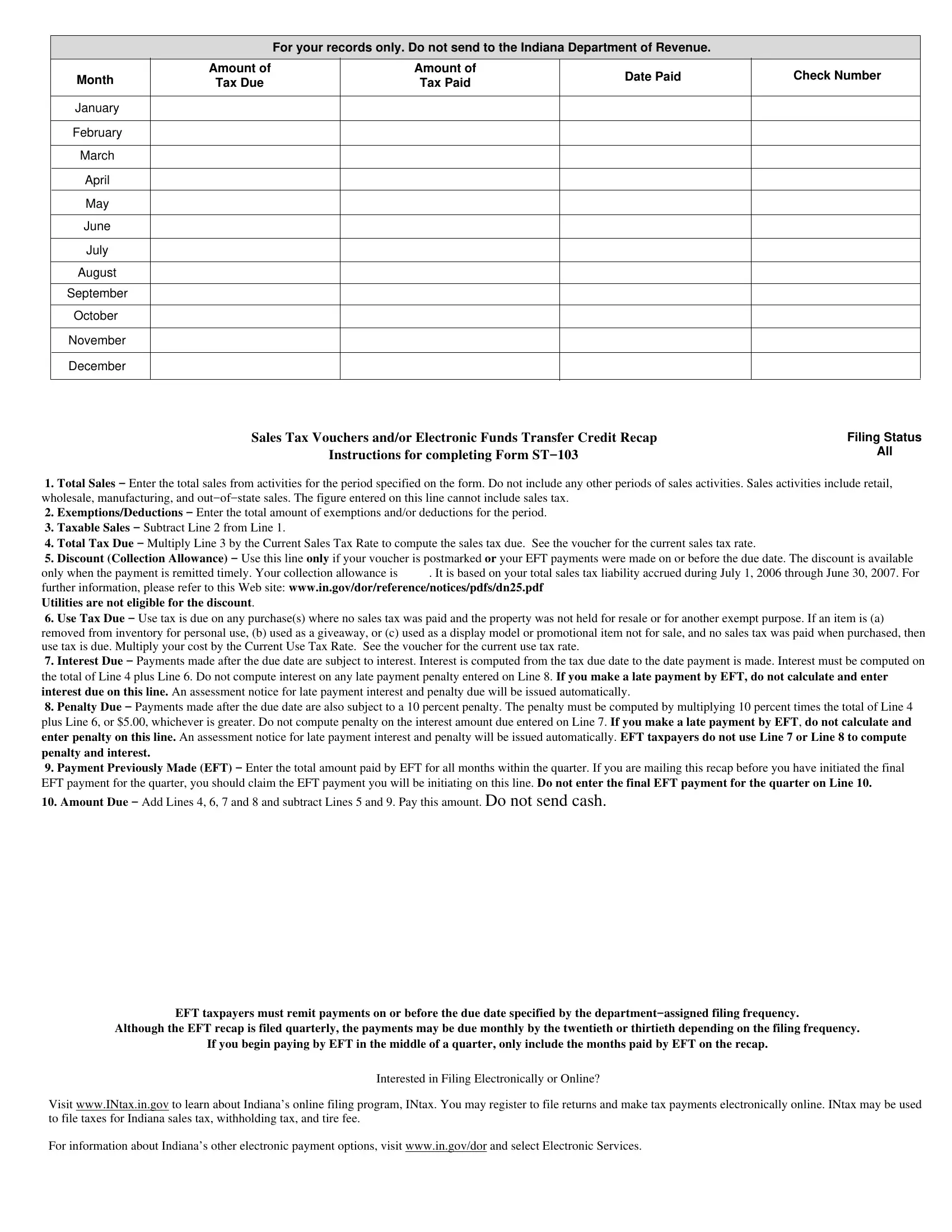

Forms required to be filed for Indiana payroll are. You are still liable for any additional taxes due at the end of the tax year. Form WH-1 Withholding Tax Voucher for EFT Early Filer.

There are several options available to taxpayers wishing to file and pay their taxes. For Medicare tax withhold. INtax supports the following tax types.

INtax is Indianas free online tool to manage business tax obligations for Indiana retail sales withholding out-of-state sales and more. Cookies are required to use this site. If the employer does withhold the ad-ditional amount it.

Indiana State Form W 4 Download

State Tax Withholding Forms Template Free Download Speedy Template

Indiana Household Employment Taxes

Local Income Taxes In 2019 Local Income Tax City County Level

In Form Bt 1 2009 Fill Out Tax Template Online Us Legal Forms

Quickbooks Learn Support Online Qbo Support How Do I File The Wh 1 For The State Of Indiana In Qbo

Tax Withholding For Pensions And Social Security Sensible Money

File 1941 Mid Year Tax Calendar For Indiana Dpla Dae89696f77e09c596eacc3c2f4a4be8 Page 2 Jpg Wikimedia Commons

Certificate Of Sales Tax Paid Or Exemption For Auctions Vehicle Or Watercraft St 108a

Annuitants Request For State Income Tax Withholding Wh 4p Indiana

:max_bytes(150000):strip_icc()/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)

W 4 Form How To Fill It Out In 2022

How We Got Here From There A Chronology Of Indiana Property Tax Laws

Indiana Bt Form Fill Out Sign Online Dochub

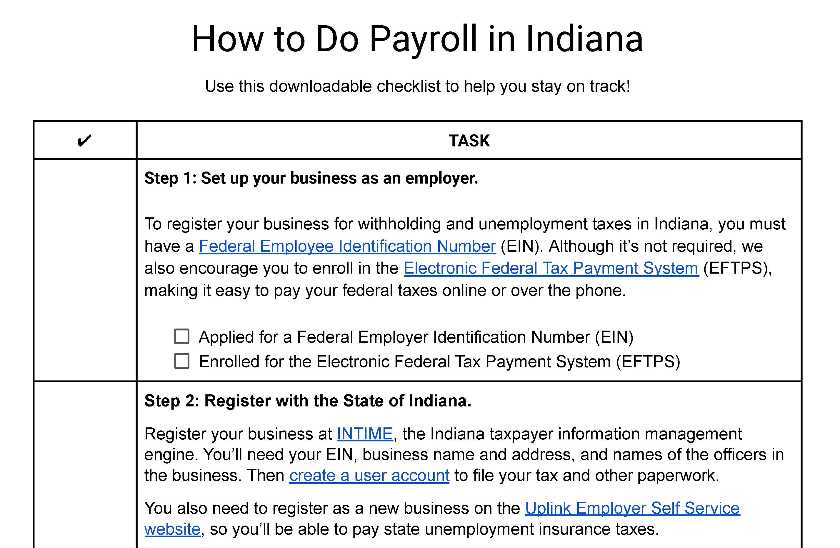

How To Do Payroll In Indiana What Every Employer Needs To Know