north carolina estate tax return

1 for Estates Trust will begin. Department of the Treasury.

The vast majority of estatesmore than 999do not.

. Federal estate tax return. Due by April 15 of the year following the individuals death. 078 of home value.

Form D-407 Income Tax for Estates and Trusts must be filed for an estate for the period from the date of death to the end of the taxable year if the estate had taxable. North Carolina currently does not enforce an estate tax often referred to as the death tax But the federal government levies the estate. When the tax collector files the foreclosure action with the court youll.

Taxpayers who filed before the Jan. Federal estatetrust income tax return. Skip to main content Menu.

In North Carolina include a complete copy of Federal Form 706. When and Where to File-- A North Carolina Estate Tax Return must be filed with the North Carolina Department of Revenue at the. Reopen the estate after probate is closed Notice to beneficiaries that they are named in a will.

Owner or Beneficiarys Share of NC. 4810 for Form 709 gift tax only. Tax amount varies by county.

105-1535a2 allows a taxpayer in calculating North Carolina taxable income to. The state of North Carolina requires you to pay taxes if you are a resident or nonresident that receives income from a California source. Statewide North Carolina Sales Tax Rate.

Form 706 Federal Estate Tax Return. The agency began accepting Estate Trust tax returns on Feb. What Is the North Carolina Estate Tax.

Form 1041 Income Tax. A fiduciary must file North Carolina Form D-407 for the estate or trust if the fiduciary is required to file a federal income tax return for estates and trusts and 1 the estate or trust derives income. What Is North Carolina Estate Tax.

Department of Revenue PO. PDF 33221 KB - January 04 2021. Then print and file the form.

Complete this version using your computer to enter the required information. The North Carolina Department of Revenue administers tax laws and collects taxes in the state of North Carolina. State and federal estate tax returns will be required only if the taxable estate is very largefor deaths in 2020 more than 11 million.

The North Carolina estate tax is equal to the amount of credit allowed for State death taxes paid on the federal estate tax return Form 706. Estates and Trusts Fiduciary. 11 opening for Corporate returns and Feb.

The North Carolina state sales tax rate is 475 and the average NC sales tax after local surtaxes is 69. Can a taxpayer deduct more than 10000 of real estate tax on a North Carolina return. The states governor appoints the secretary of revenue.

North Carolina Department of Revenue. Box 25000 Raleigh NC 27640-0635 Application for Extension for Filing Partnership Estate or Trust Tax Return North. The median property tax in North Carolina is 120900 per year for a home worth the median value of 15550000.

NC K-1 Supplemental Schedule. Detach and mail original form to. Forms E-file Information General Tax Return Information Filing Status Information Residency Information Military.

Highest Effective Sales Tax Rate. Estate Trusts. Application for Extension for Filing Estate or Trust Tax Return.

North Carolina Sales Tax. The state income tax rate is 525. The federal taxable income of the fiduciary is the starting point for preparing a North Carolina Income Tax Return for Estates and Trusts Form D-407 and.

Link is external 2021. Due nine months after the individuals death. Beneficiarys Share of North Carolina Income Adjustments and Credits.

Lowest Effective Sales Tax Rate. 2019 D-407 Estates and Trusts Income Tax Return.

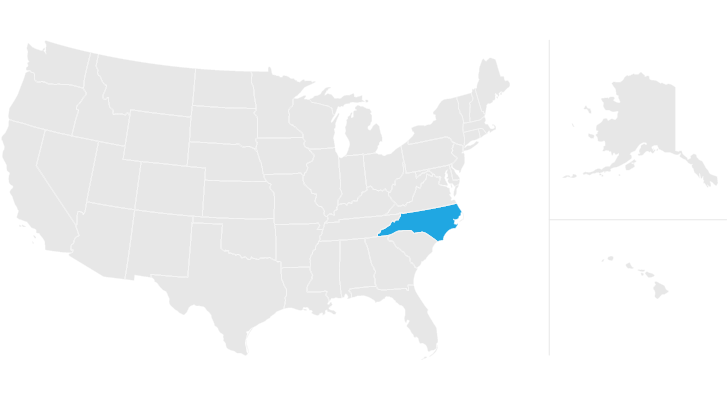

North Carolina Estate Tax Everything You Need To Know Smartasset

North Carolina Genealogy Images Of Person Co Nc Wills Estates 1792 To 1807 Tax Records From 1801 To 1806 John Barnett John Taylor William Lewis

Voice Of Hope December 2010 North Carolina Homes Murphy Nc North Carolina Mountains

Waiting On Tax Refund What Return Being Processed Status Really Means Gobankingrates

Guide To Nc Inheritance And Estate Tax Laws Hopler Wilms Hanna

Where Is My Nc Tax Refund The State Said A Delay Pushed Back The Refunds But Hopes All Will Be Completed By End Of April Abc11 Raleigh Durham

If You Are In A Financial Crisis And Cannot Pay The Irs You Will Need An Income Tax Preparation Chicago Law Income Tax Income Tax Return Tax Saving Investment

Voice Of Hope December 2010 North Carolina Homes Murphy Nc North Carolina Mountains

Irs Tax Problems Irs Taxes Tax Debt Debt Relief

North Carolina Estate Tax Everything You Need To Know Smartasset

Tax Filing Season Kicks Off Here S How To Get A Faster Refund

Income Tax Cpa Bellflower Ca Usa Tax Consulting Bookkeeping Services Income Tax

Free Printable Assignment Of Estate By Heir Legal Forms Legal Forms Resignation Form Letter Templates Free

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

Kiragelirvergisi Gayrimenkul Sahiplerini Yakindan Ilgilendiren Bir Konu Peki Kira Gelir Vergisi Nasil Hesaplan Business Expense Money Basics Estate Planning

Lake Apalachia In Murphy Nc North Carolina Travel Visit North Carolina North Carolina Mountains

Tax Pros Horrified By Irs Decision To Destroy Data On 30 Million Filers